Grifols’ tax policy is based on strict compliance with all tax obligations in all of its markets of operation. We view good tax practices as an extension of our commitment to sustainability and an integral component of our efforts to create value.

Grifols’ approach

- We believe taxes are essential to promoting social impact.

- Our corporate structures are based on commercial and industrial rationale and aligned with our business activity.

- Grifols has no presence in territories qualified as tax havens.

3 core levers

- Tax Policy

- Governance

- Legal Compliance

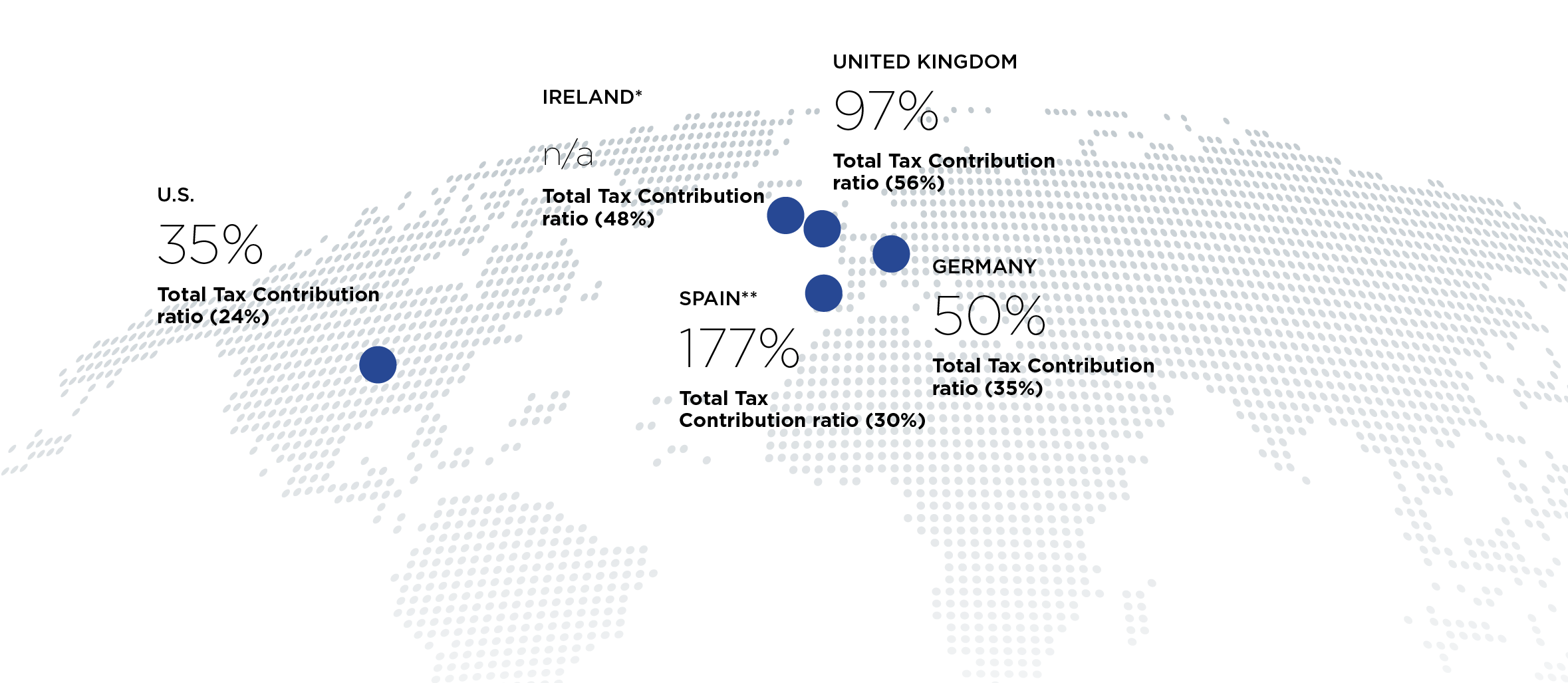

Tax contribution in 2023

Principles and good practices

Fiscal commitment

Grifols aspires to promote economic, social and industrial development by complying with the tax laws in its countries of operation and paying its fair share in jurisdictions where it creates value. The company’s corporate structures are based on commercial and industrial bases and aligned with its business activity. The company does not operate in territories qualified as tax havens.

As a core function of Grifols’ corporate responsibility, taxation issues are under the oversight of the Board of Directors, which approves and regularly monitors the group’s tax policy to ensure alignment with its current business context and commitment to sustainability. Grifols’ senior management is responsible for developing the tax strategy and tax compliance framework under the supervision of the Board of Directors. Nonetheless, its implementation may entail other corporate areas involved in routine and non-routine tasks.

The company does its utmost to develop cooperative relationships with tax authorities grounded in respect, transparency and mutual trust. To this end, on October 26, 2018, Grifols’ Board of Directors adhered to Spain’s Code of Good Tax Practices, evidence of its unequivocal commitment to transparency, good faith and cooperation. As part of its commitment to transparency, Grifols regularly reports on its tax strategy and taxes paid. The company also reports and details controversies and possible litigation in tax matters, if any, in the Consolidated Annual Accounts and in information to market regulators.

Governance

Grifols’ Board of Directors, mainly composed of independent directors, approves the Risk Management Policy, which summarizes the basic principles and framework to identify, evaluate, control and manage all types of risks, including tax risks, faced by the company and its subsidiaries.

The Audit Committee supervises the efficiency of the company’s internal control, internal audit and risk management systems, including tax risks, and periodically reviews the internal control and risk management systems to ensure that the main risks are adequately identified, managed and reported.

The Internal Audit Department assists the Audit Committee by:

- Guaranteeing adequate risk-management processes and risk assessment.

- Evaluating risk-management processes, including oversight of controls and procedures.

The Corporate Risk Committee oversees the responsibilities of Grifols’ leadership team to assess, manage and control risks, and integrate robust risk-management processes within the established system.

Legal compliance

Grifols strictly complies with current tax legislation in its countries of operation and the OECD Guidelines for Multinational Enterprises. In the U.S., the company complies with, subscribes to and reports on the Tax Control Framework Questionnaire (2019), prepared by the U.S. Internal Revenue Service (IRS). This initiative complements the OECD Model Control of Tax Risks standard by including a self-assessment mechanism to cover the essential elements in the tax risk management and control system. The principles of Grifols’ risk management and control system are subject to tax risks, which fall under the category of legal and regulatory risks.

Grifols Tax Policy

- Tax compliance is a pillar of Grifols’ economic contribution and social commitment. Its policy on compliance and good practices in fiscal matters is publicly available on its website. The payment of required taxes fully aligns with the economic activities in all jurisdictions where the Group operates.

- Grifols has no operations in territories classified as tax havens, and its business transactions with third parties based in these or any other territories form part of its ordinary industrial and commercial activity.

- Grifols rejects artificially shifting results to these territories or taking advantage of the information opacity that these territories may offer in line with the taxation principles and recommendations of the OECD’s Committee on Fiscal Affairs on international taxation matters. Transparency in tax-related matters is a core principle of Grifols’ tax policy.

- Grifols avoids significant tax risks through internal information and control systems that ensure tax matters are efficiently and expertly managed.

- Grifols’ tax policy is guided by the reasonable and careful interpretation of the tax regulations in force in each jurisdiction.

- Grifols consults with reputable independent tax advisors before making any business decision that may have fiscal repercussions.

- Grifols has a transfer pricing policy for all transactions with related parties in line with the principles of the main competent organizational bodies. This policy is reviewed annually to avoid any deviation from these principles.

- Grifols understands and supports taxation that adequately correlates with the structure and location of its activities, resources, and human resources and the business risks assumed.

- Grifols does not use artificial structures unrelated to its activity to reduce its tax burden or profit sharing.

- Grifols fosters a cooperative and fluid relationship with tax authorities based on respect for the law, trust, good faith, reciprocity and cooperation.

- Grifols collaborates with the competent tax authorities to seek solutions to achieve certainty and stability in the tax criteria applied by public administrations and to prioritize non-litigious means of resolving disputes.

- Grifols is committed to transparency, doing its utmost to provide complete information and documentation requested by tax administrations in the shortest timeframe possible.

- On October 26, 2018, Grifols’ Board of Directors adhered to the Code of Good Tax Practices.

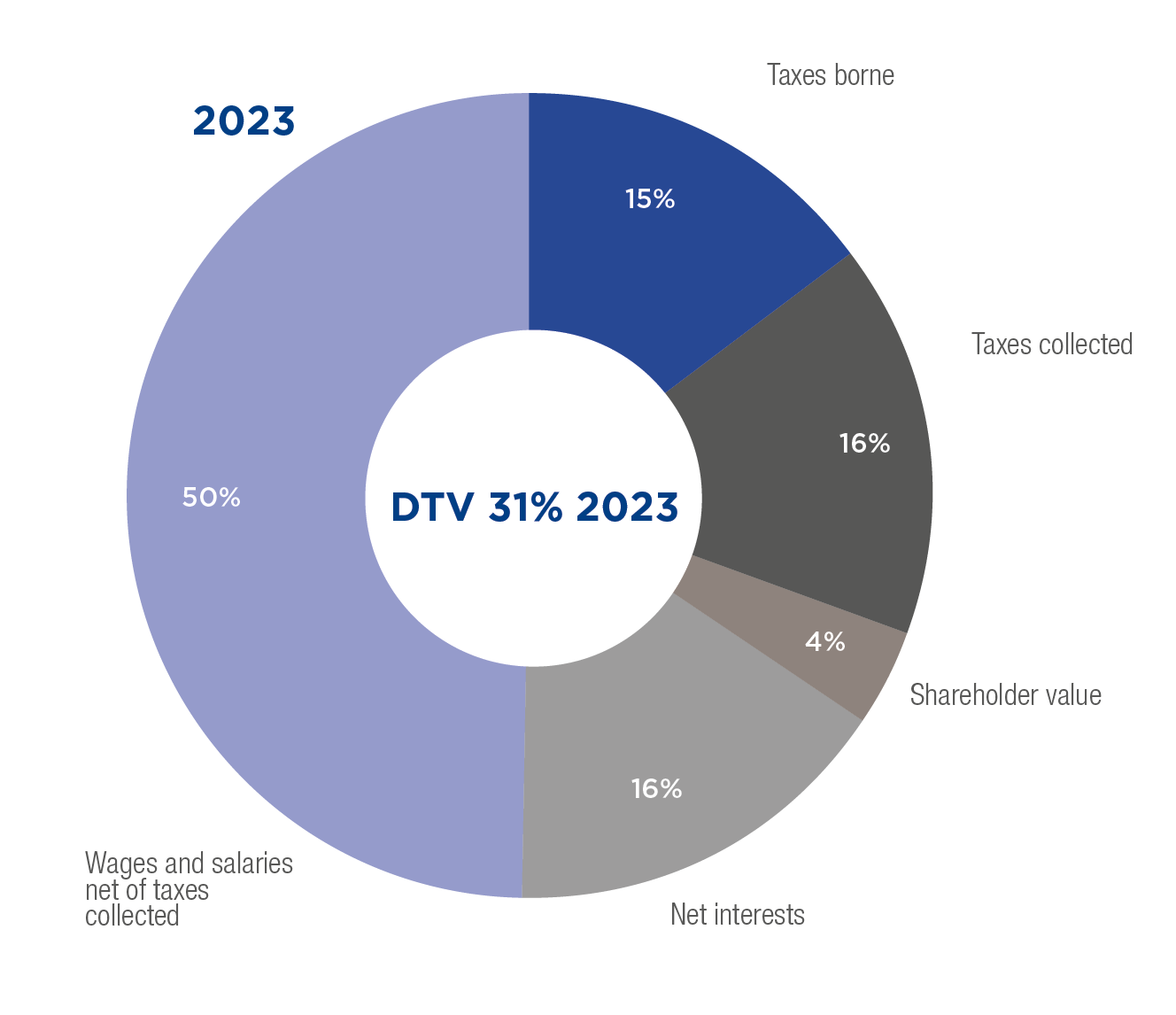

Tax contribution

Grifols reports its tax contribution in three different areas–contribution by tax, distributed tax value and contribution by geographical area–in reflection of its pledge to transparency. To this end, Grifols has adopted PwC’s Total Tax Contribution (hereinafter referred to as CTT) methodology, designed to measure the total impact of a company’s tax payments.

This methodology aligns with the OECD’s approach, which emphasizes the importance of the role of businesses in the global tax system, both as taxpayers (taxes borne) and as collectors of taxes on behalf of third parties (taxes collected). The scope of this analysis was carried out in Grifols’ main countries of operation: Spain, the United States, Ireland, Germany and the United Kingdom. These taxes include:

- Profit taxes: taxes borne on profits earned by companies such as corporate income tax, business tax and taxes levied as withholding taxes on payments to third parties.

- Property taxes: taxes on the ownership, sale, transfer or occupancy of property.

- People (or employment taxes): employment-related taxes borne and collected, which include employee income tax withholdings or social security payments payable by both the employee and the company.

- Taxes on products and services: indirect taxes on the production and consumption of goods and services, including VAT and customs duties, among others.

- Planet (environmental taxes): taxes on the supply, use or consumption of products and services that are considered to impact the environment.

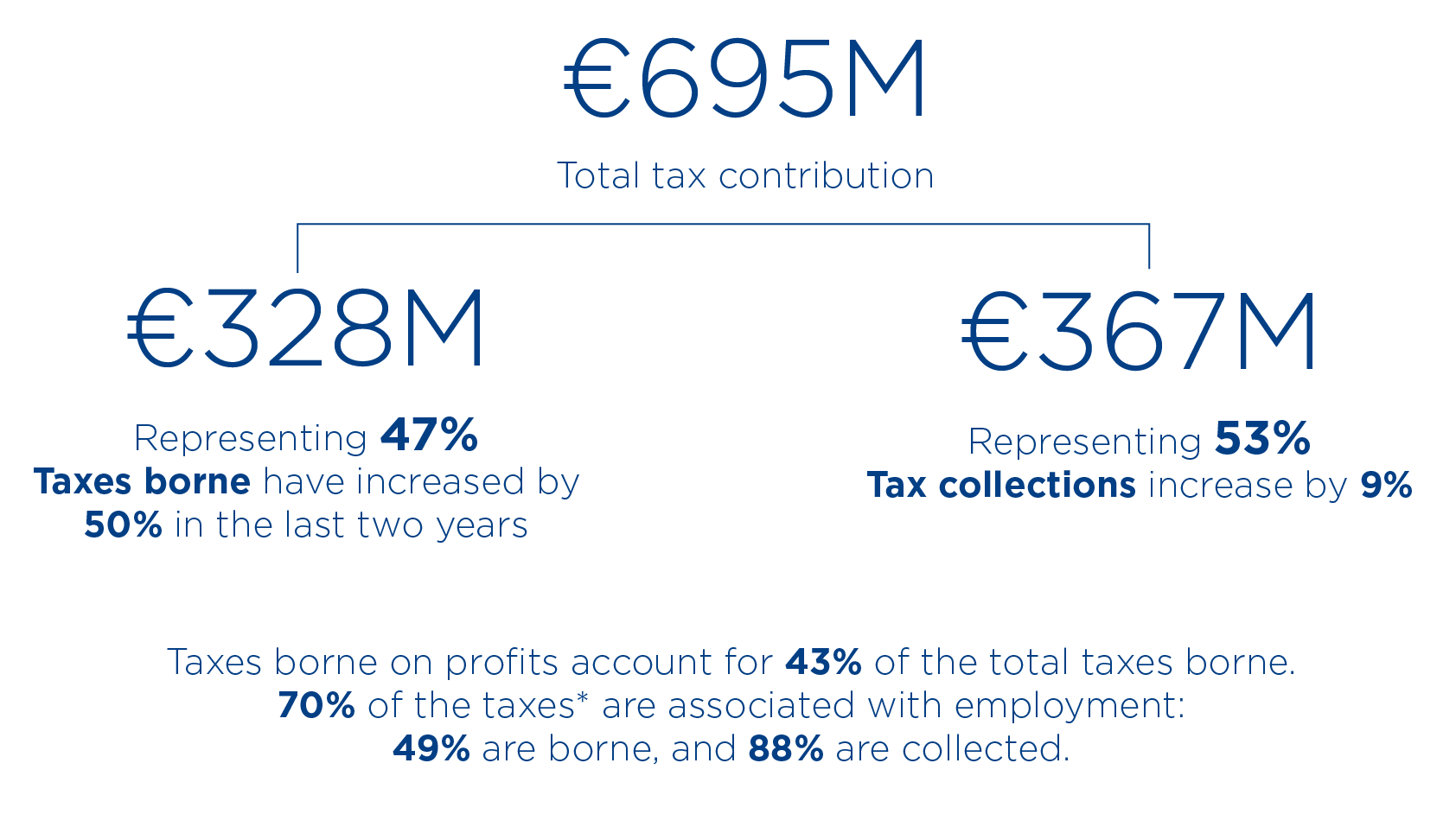

Tax value distribution

Grifols’ diverse activities generate direct and collected taxes, which are paid to global tax authorities. In general terms, these highly integrated activities can be classified into net interest, wages and salaries, taxes (borne and collected) and shareholder value.

The distributed tax value (DTV) ratio shows the percentage of the total value generated by Grifols allocated to pay taxes borne and collected from Public Administrations.

![]()

The DTV ratio stands at 31% globally for Grifols.

This signifies that 31% of the value generated by Grifols has been contributed to the public treasury through taxes paid (15%) and taxes collected (16%).

In other words, out of every €100 of value generated in 2023, Grifols has allocated €31 toward tax payments.

Contribution by geographic area

Grifols’ tax policy reflects a responsible approach to ensure good tax practices, embracing principles consistent with those set forth in OECD Guidelines for Multinational Enterprises (2011). It expressly states that Grifols has no presence in territories classified as tax havens, and that its business transactions with third parties in these territories or any other territories form part of its ordinary manufacturing and commercial activity.

Grifols is taxed on the profits generated in each of its countries of operation. Spain, the United States, Ireland, Germany and United Kingdom account for more than 70% of the group’s global revenue, and its main industrial and R&D+i facilities are primarily located in these countries.

| Million euros | Profit* | Taxes paid** | Total tax contribution*** | % |

| U.S. | 325.7 | 99.8 | 395.0 | 57% |

| Spain | (0.3) | 31.3 | 190.0 | 27% |

| Ireland | (110.8) | 1.8 | 55.0 | 8% |

| Germany | 123.1 | 9.3 | 49.0 | 7% |

| Rest of the world | 37.8 | 11.7 | n/a | - |

* Profit after tax in 2023, excluding dividends and impairments or disposals in Group Companies.

** Net tax payable for 2023.

*** For the Total Tax Contribution (CTT) in the United States, a exchange rate of 1.07898 euros per dollar has been used. In the U.S., the total contribution has decreased compared to the previous year due to adjustments made as part of the operational improvement plan. The calculation of the Total Tax Contribution excludes Biotest and other entities from the Rest of the World.

Tax contribution according to Grifols’ operations

*In Ireland, it is not possible to calculate the total tax contribution ratio for 2023 due to a negative result in the 2023 fiscal year. Despite the losses incurred in 2023, Ireland has significantly increased its total tax contribution (+11% compared to 2022).

**In Spain, the tax contribution ratio is distorted (above 100%) as a consequence of pre-tax losses in 2023. While this accounting situation results in a negative outcome, it does not impact tax payments. The impairment caused by this negative result is considered non-deductible for tax purposes, thus not affecting the taxable income of the Group in Spain.