We boast strong fundamentals and a clear growth strategy focused on profitability. Through ongoing efforts to enhance our operations and financial performance, we strive to create value, leverage our strengths in order to fulfill our objectives, priorities and commitments.

Our roadmap

- Profitable operational growth

- Progress on our commitment: debt ratio of 4x

- Financial discipline and cost control

- Continued efforts to explore and capture opportunities in China and with Biotest

- Promote impactful and differential R&D projects

5 strategic drivers

-

Focusing on core activities

Focusing on core activities

-

Improving the donor’s experience

Improving the donor’s experience

-

Driving forces and creators of the global market

Driving forces and creators of the global market

-

Continuous optimization

Continuous optimization

-

Accelerating innovation

Accelerating innovation

Milestones in 2023

-

Robust and sustainable income growth

+10.9%

CC1

-

Increase

in plasma

supply+10%

-

Reducedón del

cost per liter

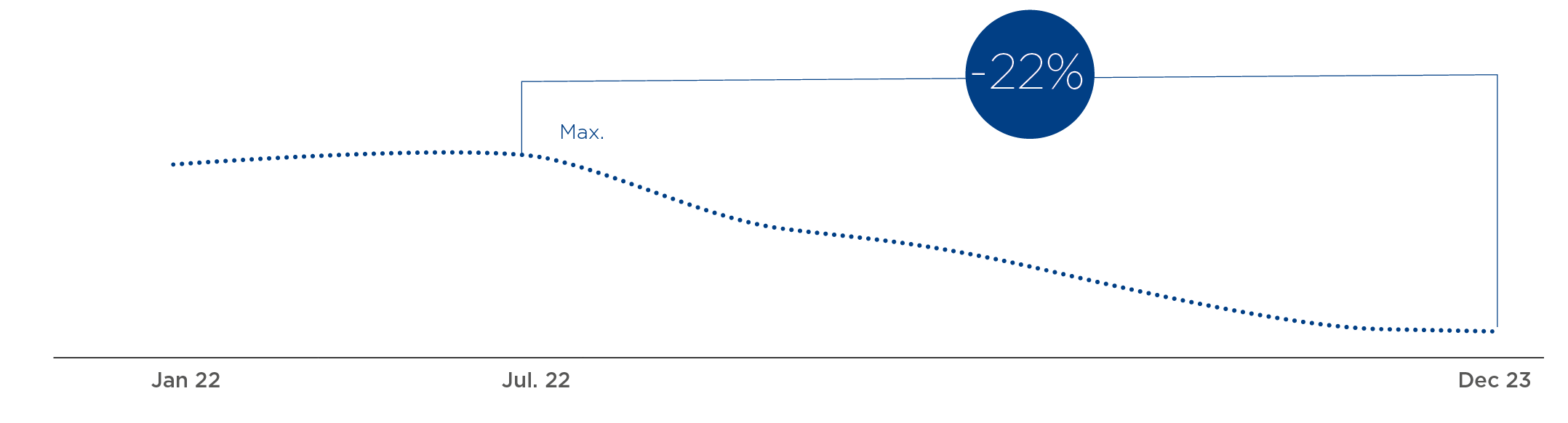

of plasma-22%2

-

Debt ratio

6.3x

-

Announcement of

Haier alliance$1,800 M

Sale of 20% SRAAS while maintaining a relevant presence in China

-

Operational

cash flow3€+300M

(1) Operating or constant exchange rate (cc) excludes exchange rate variations for the year.

(2) In relation to the peak recorded in July 2022.

(3) Excluding extraordinary items.

A commitment to value creation

For Grifols, 2023 was a year of growth and transformation. The company closed a decisive year that will accelerate its growth in 2024, delivering on its commitments and making strides across the board as evidenced by its positive operating and financial results. Grifols also advanced on its deleveraging path by forming a strategic alliance with Haier Group in China.

Grifols recorded significant savings in 2023 thanks to notable progress on its operational improvement plan, announced at the end of 2022. In parallel, it continues to progress on its strategic roadmap, developed in 2022 to increase its capacity to detect and address new challenges. Financial performance and shareholder value creation remain core commitments.

|

Our priorities |

Levers |

|

Stronger leadership and a more efficient organization A more effective, performance-driven and agile company |

|

|

Equipped to meet debt maturities |

|

|

Debt reduction Balance sheet deleveraging |

|

|

Improved cash flow and expense Profile Financial discipline and cost control |

|

|

Capture sales opportunities Unlock value of product portfolio |

|

|

Biotest Solid value plan |

|

|

China: bolster our market position |

|

Solid

Solid execution

Open communication:

Open communication: transparency

and clarity

Proven

Proven Resilience

Guided by

Guided by our core values

while promoting

sustainability

Significant revenue growth

| Grifols | Biotest | Combined1 | |

| Revenue | 6,089 | 503 | 6,592 |

| % variation | +6.8% | +39.3% | +8.7% |

| % variation cc | +9.1% | +39.4% | +10.9% |

| Gross margin | 2,396 | 98 | 2,495 |

| % margin | 39.4% | 19.5% | 37.8% |

| Operational expenses | 1,585 | 177 | 1,762 |

| % variation cc | +10.3% | +83.3% | +14.9% |

| EBITDA | 1,265 | (14) | 1,251 |

| % margin | 20.8% | (2.7%) | 19.0% |

| EBITDA adjusted | 1,455 | 19 | 1,474 |

| % margin | 24.0% | 3.9% | 22.4% |

| Group profit | 113 | (54) | 59 |

| % variation | (49.6%) | - | (71.5%) |

Strong revenue growth to year-on-year highs. Biopharma’s main plasma proteins recorded strong performance, driven by higher plasma supply, robust underlying demand for key proteins, the price factor, a favorable product mix, and notable contribution from Biotest.

Higher gross margin following a significant decline in cost per liter (CPL) of plasma. Grifols optimized its plasma center network as part of its operational improvement plan, while plasma supply continued to sustainably grow. Donor compensation also moderated, further contributing to greater margins.

Enhanced operating performance increases EBITDA. Grifols’ operational improvement plan, now fully implemented, has led to significant margin expansion. The company achieved EUR 450 million in annualized cash cost savings thanks to the positive results of diverse actions to optimize its plasma operations.

Group profit were affected by high financial expenses.

Performance by business unit

Biopharma

Positive evolution of Biopharma

Total revenues

5,558 M

+11.0% +13.3% cc

GRIFOLS

5,055 M

+8.9%

+11.3% cc

BIOTEST

503 M

IMMUNOGLOBULINS

+17.2% cc

55-60% of revenues

- Continued strong demand for intravenous immunoglobulins (IVIg)

- Subcutaneous (IgSC) Xembify® grows thanks to higher penetration the U.S. and other key markets

- Objectives to bolster franchising in the U.S. and accelerate Xembify® adoption in other countries

ALBUMIN

+20.1% cc

10-15% of revenues

- China drives demand in the Asia-Pacific region

- Grifols’ innovative sales strategy under the SRAAS agreement leads to greater supply in the Chinese market

- Solid evolution in the main European countries

ALPHA-1 & SPECIALTY PROTEINS

+0,2% cc

25-30% of revenues

- Gradual recovery of alpha-1 in European countries has led to a growth of +2.4% year-on-year in the last quarter

- U.S. market launch of AlphaID™ At Home text

- Positive evolution of hyperimmune immunoglobulins (Ig) in the U.S.

Commercial milestones in 2023

We continue to strengthen our immunoglobulin franchise by focusing on the fastest-growing immunodeficiency markets such as primary and secondary immunodeficiencies, while maintaining our leadership in neurology and intensive care.

Launch of subcutaneous immunoglobulin XEMBIFY® in Europe and Australia

Spain and the United Kingdom (Wales) were the first European markets to introduce this plasma-based medicine after its approval by several European health authorities in 2022. Approved indications include primary immunodeficiencies (PIDs) and secondary immunodeficiencies (SDIs). In 2023, Xembify® was also launched in Australia.

XEMBIFY® has held a patent in the United States since 2019. Grifols is currently working to obtain clearance for its indication to treat hypogammaglobulinemia and recurrent or severe infections associated with B-cell chronic lymphocytic leukemia (CLL), among the indications with the greatest growth potential in the SID field.

First exports to China of Biotest albumin

The collaboration among Grifols, Shanghai RAAS and Biotest led to a higher supply of albumin in China. Grifols has six albumin product licenses in China and distribution rights for Biotest’s albumin as of January 2023. Grifols supplies albumin under the Shanghai RAAS framework, an exclusive 10-year distribution agreement (extendable for another 10 years).

TAVLESSE® market expansion in Europe

TAVLESSE® (fostamatinib), indicated to treat immune thrombocytopenia (ITP) in adult patients refractory to other treatments, was introduced in Norway and the Czech Republic. It also received a recommendation from the United Kingdom’s National Institute for Health and Care Excellence (NICE). TAVLESSE® represents Grifols’ first non-plasma therapy.

Expansion of the biological sealant VISTASEAL™ to new markets

Used to control surgical bleeding, the biological sealant VISTASEAL™ was launched in Canada, Italy, Switzerland, Estonia, Lithuania, Latvia and Australia. The product combines two plasma proteins (fibrinogen and human thrombin) and is administered with Ethicon’s innovative applicator technology.

Plasma is a priority: supply and cost per liter continue to improve

Higher Plasma Volumes

+10%

vs 2022

Lower Cost

-22%

LITER OF PLASMA*

-5%

MANUFACTURING COST

Plasma Centers

390+

Cost per liter evolution (CPL)

Note: Base 100: 1Q-22; a 22% decline by December ‘23 compared to the peak in July ‘22 (U.S. information excluding Biotest)

Higher plasma volumes and plasma-center optimization

- Upturn in number of unique donors to 920,000 people

- Greater donation frequency

- Implementation of new more efficient plasmapheresis machines

Several measures improve plasma CPL

- Moderation of donor compensation

- Rationalization of plasma center network

- Greater process efficiencies

- Optimized cost structure

- Enhanced donor experience

Diagnostic

Diagnostic

Total Revenues

€670 M

-0.1% +2.3% cc

Recovery driven by the growth of blood typing solutions and positive trend in China

NAT TECHNOLOGY

+0.4%

50-55% of sales

- Extension of agreement with CTS to 20 years in the U.S.

- Higher instrument sales in Japan and Indonesia

BLOOD TYPING

+8.9%

25-30% of sales

- Notable growth in most countries, especially in the U.S., Argentina, Brasil and Saudi Arabia

RECOMBINANT PROTEINS

+2.3%

15-20% of sales

- Strong revenues in main regions, especially in the U.S.

- Important 10-year supply agreement with a leading partner

Pre-transfusion compatibility testing in multiple myeloma patients

Grifols sCD38 solution received the CE mark. Designed to block anti-CD38 antibodies, it is the first soluble recombinant protein to facilitate pre-transfusion compatibility testing in patients with multiple myeloma. This solution designed to block anti-CD38 antibodies demonstrates Grifols’ ongoing commitment to innovation and patient safety.

AlphaID™ At Home is now available in the U.S.

Available in the U.S. as of May 2023, this free screening program allows people to easily discover their genetic risk of alpha-1 antitrypsin deficiency (AADT) through a saliva sample. Many COPD patients are unaware of its genetic component, which is why the WHO, COPD Foundation and other health organizations recommend detection tests, as low levels of the alpha-1 antitrypsin protein can cause severe lung and liver diseases. AlphaID™ At Home received FDA clearance in 2022, becoming Grifols’ first FDA-approved product for direct consumer use.

Bio Supplies

BIO SUPPLIES

TOTAL REVENUES

€160 M

+9.5% +11.3% cc

Grifols continues to maximize the value of its Bio Supplies product portfolio after integrating Access Biologicals, which continues to contribute significantly. The unit also benefited from strong sales of hyperimmune plasma to third parties

BIO SUPPLIES BIOPHARMA

+5.1%

55-55% of sales

- Increase due to the growth of traditional activity driven by new customers and higher demand from existing clients

- Reduced revenue contribution from cell culture media due to lower market demand

BIO SUPPLIES DIAGNOSTIC

+29.4%

25-30% of sales

- Increased demand for plasma for diagnosis and contributions resulting from the acquisition of Access Biologicals.

- Improved margins for blood derivatives due to the operational optimization plan.

PLASMA HIPERINMUNE SALES

+4.8%

20-25% of sales

- Boost from new contracts

First leukopak donations in the U.S.

In 2023, the first leukopak donations began at Bio Supplies’ Specialty Plasma Center in Indianapolis, Indiana. Primarily used in cell-therapy research, leukopaks are obtained through apheresis whereby a specific blood component is extracted. In this case, leukocytes or white blood cells are procured from the donor (leukapheresis).

Bio Supplies has a broad portfolio of products for cell therapy, including human AB male serum and albumin. Grifols is the market leader in their supply.

Until now, Grifols leukopaks have only been marketed in Europe. Following its positive experience in its German centers, the company quickly implemented leukopak donations in the U.S., where it plans on bringing this type of apheresis to more plasma centers to bolster its cell-therapy business.

Reinforcing the balance sheet

Proven commitment to sustainable growth

A solid balance sheet with investments already made

EUR 21,441 million as of December 31, 2023, compared to EUR 21,534 million in December 2022. The strategic investments made in recent years to boost plasma acquisition and reinforce innovation projects have been highly relevant factors in strengthening Grifols’ growth.

Inventory control, collection and payment periods

The inventories remain stable, amounting to EUR 3,459 million, with a turnover of 308 days (296 days as of December 2022). This stability is attributed to the gradual impact of improved cost per liter of plasma in a context of increased supply. The average collection and payment periods have remained steady at 36 days (36 days in 2022) and 59 days (53 days in 2022), respectively. The average payment period to suppliers of the Spanish companies comprising the group has been 72 days, mirroring the same average period as the previous year, which stood at 69 days.

Enhanced management of working capital

Better working-capital management continues to optimize Grifols’ financial structure. As of December 31, 2023, the company’s liquidity position stood at a robust EUR 1,145 million, including EUR 530 million in cash.

Operational Improvement and cost savings plan

Fully executed in 2023 to reduce the cost base, the plan has elevated Grifols’ operating cash flow and financial performance, leading to over EUR 450 million in annualized cost savings. Due to the approximately nine-month lag in inventory accounting applied in the plasma industry, most of the savings will be recognized in the income statement in 2024.

*Data including Biotest except for average payment period

![]()

Total Assets

€21,441 M

Liquidity Position

€1,145 M

Cash Position And Other Liquid Resources

€530 M

Noteworthy progress on our commitment to deleverage

Deleveraging remains a core priority for Grifols on its pursuit to reduce debt.

At the close of 2023, Grifols’ debt ratio fell to 6.3x (7.1x at December 2022) following an improvement in EBITDA and operating cash flow generation, which stood at EUR 208 million in 2023 (EUR 351 million excluding exceptionals), driven by dynamic business momentum and optimization of working capital.

Including the SRAAS divestment, the ratio would stand at 5.4x (pro forma). Grifols continues to progress toward its goal of reaching 4.0x.

Equity

On December 31, 2023, shareholder equity totaled EUR 7,972 million. Grifols share capital is represented by 426,129,798 ordinary shares (Class A), with a nominal value of EUR 0.25 per share, and 261,425,110 non-voting shares (Class B), with a nominal value of EUR 0.05 per share.

Grifols ordinary shares (Class A) are listed on the Spanish stock market and form part of the IBEX-35 (GRF), and non-voting shares (Class B) are listed on the Spanish stock market (GRF.P). Grifols Class A and B shares are also listed on NASDAQ (GRFS) through ADRs (American Depositary Receipts).

As announced following its 2021 acquisition of Biotest, the company will suspend the distribution of cash dividend payments until attaining a debt ratio below 4x/EBITDA.

![]()

Leverage ratio at closing 2023

6.3x

Proforma considering divestment in SRAAS

5.4x

Equity

7,972 M

-5.3%

Grants

The grants received mainly correspond to initiatives related to the training of workers and the creation of jobs.

| Thousand of Euros | Grants |

| Spain | 468 |

| United States | 1,305 |

Liquidity and capital resources

The leverage ratio dropped to 6.3x (5.4x pro forma considering the SRAAS divestment). Grifols is making important progress toward its goal of reaching 4x. The liquidity position totaled EUR 1,145 million, including a cash position of EUR 530 million.

Cash flow from operating activities

In 2023, net cash flows from operating activities continued on their positive trend, fueled by solid business performance and the effective 100% implementation of the operational improvement plan, and the engine for over EUR 450 million in cost savings. Operating cash flows reached EUR 208 million (EUR 351 million excluding exceptionals), compared to the EUR -11 million reported in 2022.

Cash flow from investment activities

The net cash flows allocated to investment activities have amounted to EUR 398 million, with the most significant portion attributed to capital investments (CAPEX), totaling EUR 210 million. These investments have primarily focused on new Biopharma production facilities, including the upgrade of plasma fractionation, immunoglobulin purification, and albumin plants in Montreal (Canada), as well as the establishment of a new albumin plant in Dublin. Additionally, funds were allocated to various IT and digitization projects.

Cash flow from financing activities

The cash flow from financing activities amounts to EUR 186 million.

Capital resources and credit ratings

As of December 31, 2023, Grifols’ net financial debt stands at EUR 9,416 million, excluding the impact of IFRS 16*.

In 2023, the company continued to decrease its debt ratio both organically and inorganically through divestitures of specific assets. As part of its quest to reduce inorganic debt, Grifols announced a strategic alliance with Haier Group on December 29, 2023, which includes the sale of 20% of SRAAS capital for USD 1,800 million.

In December 2023, the company’s net financial debt to EBITDA ratio stood at 6.3x and 5.4x pro forma considering the SRAAS divestment. The company is making steady progress on its goal of reaching 4x.

Grifols also made important strides in optimizing its financial structure. At the time of writing, 59% of Grifols’ debt was referenced at fixed interest rates. While there are no significant debt maturities before 2025 and no financial covenants, this financial structure lessens the impact of interest rate hikes.

Grifols expects to meet its 2025 debt maturities in the first half of 2024 by using proceeds from its SRAAS divestiture. With the support of its main banks, the company has marked a clear path to fulfill its expected maturities on time, while remaining steadfast in its pledge to meet its debt reduction targets.

*As of December 31, 2023, the impact of IFRS 16 on debt amounted to EUR 997 million.

| Current Credit Ratings | Fitch1 | Standard &Poor's2 | Moody's3 |

| Corporate Rating | BB- | B+ | B2 |

| Senior secured debt | BB+ | BB- | Ba3 |

| Senior unsecured debt | B+ | B- | Caa1 |

| Outlook | Stable | Stable | Negative |

1. Last review in september 2023 / 2. Last review in january 2024 / 3. Last review in march 2023

CAPEX and industrial activity

Grifols advanced on its capital investment plan to expand and enhance the production facilities of its business units. The company improved its CAPEX structure, taking into consideration investments made in recent years and maintaining strict discipline in resource allocations. In 2023, capital expenditures stood at EUR 210 million, denoting a slight decrease from the EUR 298 million allotted in 2022.

U.S.: FDA approves new purification and filling plant in Clayton, NC

The immunoglobulin (Gamunex-C®.) purification and filling plant in Clayton, North Carolina, received FDA clearance, allowing the company to expand operations when additional capacity is required. Following this approval, the Clayton plant increases its Gamunex production capacity by up to 16 million grams, representing an upturn in production capacity of intravenous immunoglobulin (IVIg) of more than 70%.

U.S.: New fractionation plant is operational. +6 M liters of plasma/year

The new plasma fractionation plant in North Carolina is now operational, giving Grifols additional fractionation capacity of six million liters of plasma equivalent.

Spain: construction under way of a fibrin and topical thrombin plant

Construction continued in 2023 on a fibrin adhesive and topical thrombin production plant. Located in Barcelona, it will expand production capacity up to 3.3 million liters of equivalent plasma annually for fibrin adhesive production and 6.4 million liters of equivalent plasma annually for topical thrombin production.

Ireland: new albumin purification plant

Grifols inaugurated its new sterile albumin purification, dosing and filling plant in Dublin in flexible packaging, tripling its capacity for filling albumin in this format. The installation incorporates the latest eco-efficiency technologies to save energy and water, testament to Grifols’ leadership in industrial design and engineering.

Canada: upgrades to Quebec fractionation and purification facilities

Upgrades continue on Grifols’ industrial installations in Quebec, Canada, which include a fractionation plant with a capacity of 1.5 million liters of plasma per year, and two purification plants.

More details on agreements with Egypt and Canada: “Donors and Patients” chapter.

Corporate transaction and acquisitions

Strategic alliance with Haier Group

As part of its efforts to strengthen and enhance China’s healthcare system, Grifols will sell a 20% stake in SRAAS to Haier for USD 1,800 million in cash, which will be used in its entirety to reduce debt. Grifols will retain a stake of ~6.58% in SRAAS and a member on its board of directors.

On December 29, 2023, Grifols announced a strategic alliance with Haier Group to further develop the Chinese plasma market. Together, the companies will explore synergies and opportunities to merge Grifols’ excellence in pharmaceuticals and diagnostics with Haier’s impressive portfolio of healthcare solutions.

Through a share purchase agreement, Grifols will sell approximately 20% of its stake in SRAAS to Haier for RMB 12,500 million (USD 1,800 million) in cash at RMB 9.405 RMB per share. This share price represents a 14.96% premium over the volume-weighted average price of SRAAS shares over the previous 20 trading days (RMB 8.181).

Grifols will allocate the proceeds from this transaction, subject to regulatory approvals and other standard closing conditions, to reduce its debt levels.

The company will continue to hold a significant stake of ~6.58% in SRAAS and have a member on its board of directors.

Grifols Diagnostic Solutions (GDS) will maintain 45% of the economic rights and 40% of the voting rights of SRAAS, as agreed upon in 2020.

Since joining forces three years ago, Grifols and SRAAS have positively collaborated to develop the plasma-based medicines market in China.

Under the share purchase agreement, Grifols and SRAAS will extend their exclusive albumin distribution agreement for at least the next ten years (with the possibility of extending for a further ten years), with guaranteed minimum supply volumes for the next five years (2024-2028). China currently accounts for over 50% of global albumin consumption, with demand expected to continue growing in the coming years.

![]()

The transaction by the numbers:

Sale of 20% stake in SRAAS

1,800 M$ to reduce debt

Grifols maintains ~6.58% share capital and 1 member on the board

Biotest: progress on the integration process

The acquisition of Biotest AG is a strategic transaction which will increase and diversify Grifols’ supply of plasma; reinforce its operations and revenues in Europe, the Middle East and Africa; and elevates its economic performance as the development of plasma proteins in their pipeline becomes evident.

On April 25, 2022, Grifols announced the closing of the 100% share acquisition of Tiancheng (Germany) Pharmaceutical Holdings AG, a German company that controlled 89.88% of Biotest AG ordinary shares and 1.08% of its preferred shares. After closing the transaction, which included a takeover bid for the outstanding capital, Grifols controls 97.13% of Biotest AG’s voting rights and holds 70.18% of its share capital.

Since the operation, Grifols and Biotest have collaborated in several areas, especially R&D+i. In 2023, progress was also made in the sales function, especially in key markets such as Germany, Brazil, Spain, Italy and the United Kingdom.

Through these collaborations, Grifols fosters the exchange of knowledge and helps expand portfolios of life-sustaining products and their geographic scope in benefit of healthcare professionals and patients.

In this regard, in February 2024, Grifols announced positive topline results from Biotest’s phase 3 clinical trial for the fibrinogen concentrate, BT524. The next steps include initiating regulatory processes in Europe and the United States, where it is set to become the first approved fibrinogen concentrate for acquired fibrinogen deficiency (AFD), with an estimated market potential of up to $800 million.

Biotest’s advancements, including other innovations like Yimmugo and Trimodulin, reinforce Grifols’ position in plasma-derived medicines and underscore the company’s commitment to addressing unmet medical needs through innovative solutions.

For more information on Biotest’s progress and new product development, see the “Innovation” chapter.

For more information on the results of Biotest’s phase 3 clinical trial with fibrinogen, consult the press release.